Help Centre

Support > Ecommerce > Postage Setup

How to set up Auto VAT

The Auto VAT feature allows you to assign VAT categories to each of your products, meaning the correct VAT will then be automatically calculated at checkout.

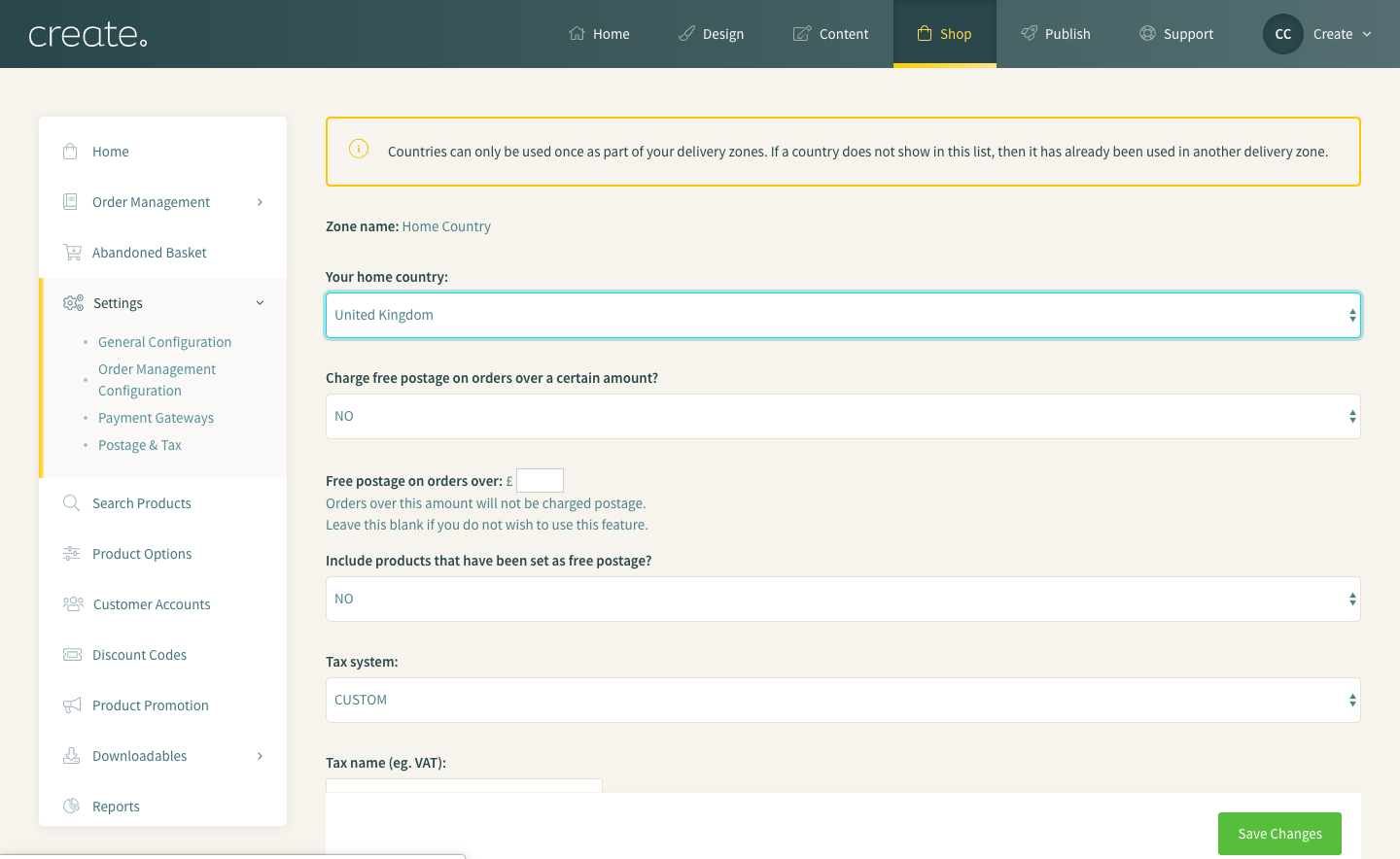

As the Auto VAT feature currently only takes into consideration UK VAT categories, this will only work for customers who have their Home Postage Zone set to the UK - though you don’t need to be residing in the UK to be eligible.

If you have the Auto VAT feature added to your Create account, you can follow the below steps to access the settings:

- Log in to your Create account

- Click 'Shop' on the top menu

- Click 'Settings' in the left-hand menu

- Choose 'Postage & Tax'

- Click 'Edit Zone' next to your home country's postage settings.

You should see the 'Tax System' option allowing you to select between 'OFF', 'CUSTOM' and 'AUTO'. Below is how each of these options work.

OFF

Simply put, OFF means off and will disable the Auto VAT feature.

CUSTOM

This is currently how your Tax is set up prior to adding the Auto VAT feature.

You can choose the amount of tax added at checkout in the 'Tax Rate' box.

Allows you to set prices to be inclusive or exclusive of Tax.

AUTO

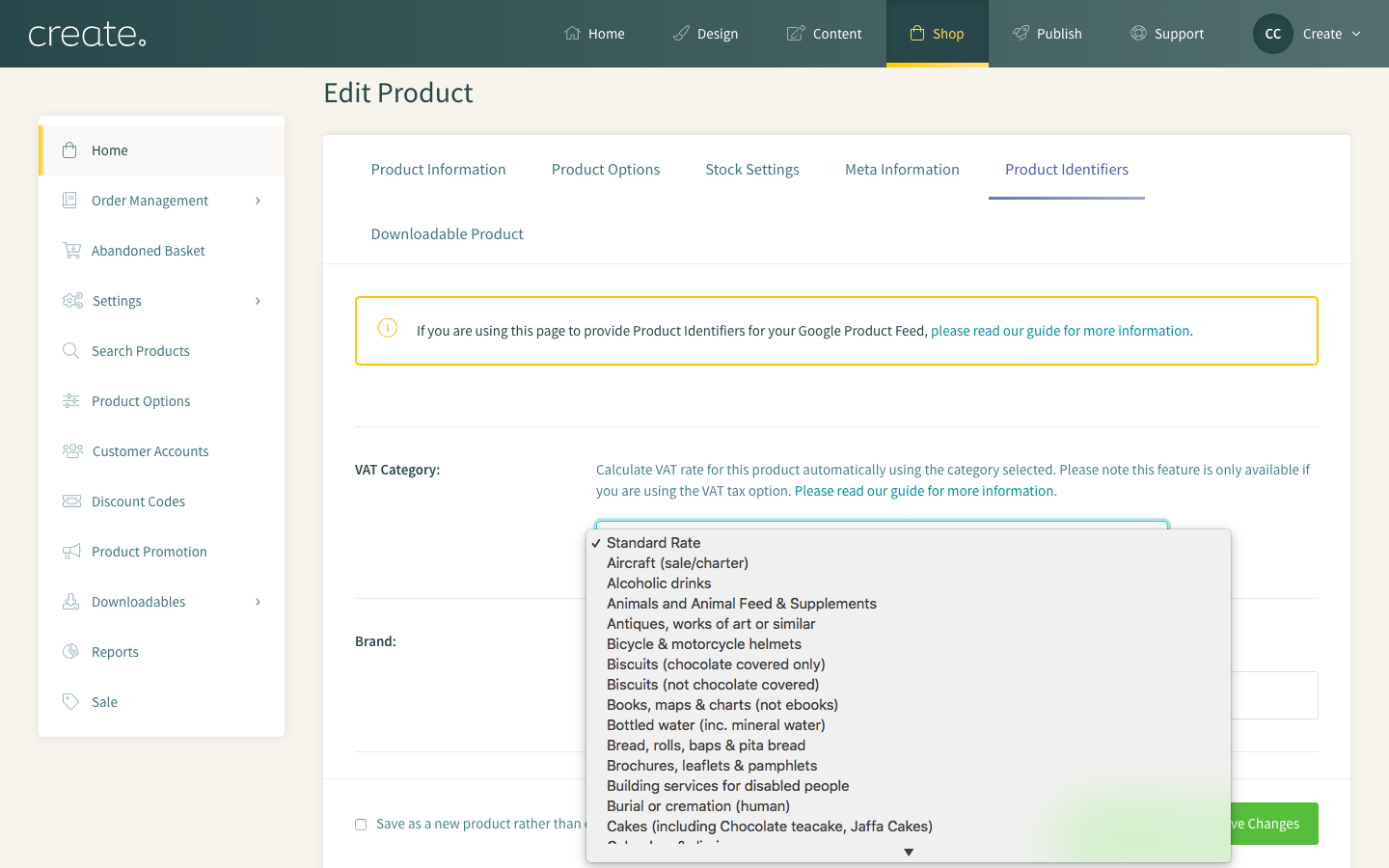

AUTO will also allow you to assign VAT categories against your products which is then automatically calculated at the checkout. You will need to set the VAT category to each individual product. This can be done using the below steps:

- Click 'Shop' on the top menu

- Click to 'Edit Product' on the product you would like to edit

- Select the 'Product Identifiers' tab

- You should now see the 'VAT Category' option.

The AUTO setting will also automatically deduct VAT/tax from the order total if the delivery country selected at the checkout isn't subject to tax (in line with UK tax legislation). This specific setting is only applicable when you offer prices that are inclusive of tax, please use the CUSTOM setting if you wish to apply separate or additional tax rules when offering exclusive of tax prices. In line with UK VAT, the amount of tax deducted at the checkout will be 20%. The amount of tax deducted will be updated in accordance with any changes to UK tax legislation.

Please note that the AUTO feature will only function as detailed when the United Kingdom is selected as the home country within Postage & Tax.

Related Articles

More Questions?

If you have any further questions, please get in touch and we will be happy to help.

Get in Touch